will child tax credit payments continue in january 2022

For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. If no measure is taken the Child Tax Credit will revert to the pre-2021 Child Tax Credit where qualified families would be able to claim up to 2000 per qualifying child under the age of 17.

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It

Child tax credit amount 2022.

. Making the credit fully refundable. To be eligible for the full child tax credit single parents must have a modified adjusted gross income under 75000 per year. No monthly CTC.

The first half was sent in 6 payments once per month from July until this MoreChild Tax Credit. Ad Discover trends and view interactive analysis of child care and early education in the US. The money will come at one time when 2022 taxes are filed in the spring of 2023.

Simple or complex always free. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

Will child tax credits continue beyond 2022. But this may not. For couples filing jointly who make up to 400000 the amount is 1400.

The legislation needs the votes to pass but with Congressional break and division among some democrats any vote will now come in the new year. Starting from January 1 2022 taxpayers that are eligible for the credit wont be getting the child tax credit advanced payments. File for 2022 tax season.

However President Joe Biden s administration is crafting a bill that would return the payment in February with a back payment issued for the missed January installment. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021.

Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child. After families were issued their third child tax credit check this week theyll have three more payments in 2021 and one in 2022. The monthly payments of the child tax credit have been a helpful perk to the increased amount for the second half of 2021.

President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. Due to changes made in the American Rescue Plan to help. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Advance Child Tax Credit Payments in 2021. File a federal return to claim your child tax credit. The benefit is set to revert because.

For more information regarding eligibility and how advance Child Tax Credit payments have been disbursed see. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. A bill drafted by the Biden administration could cover back payments of the 2022 child tax credit.

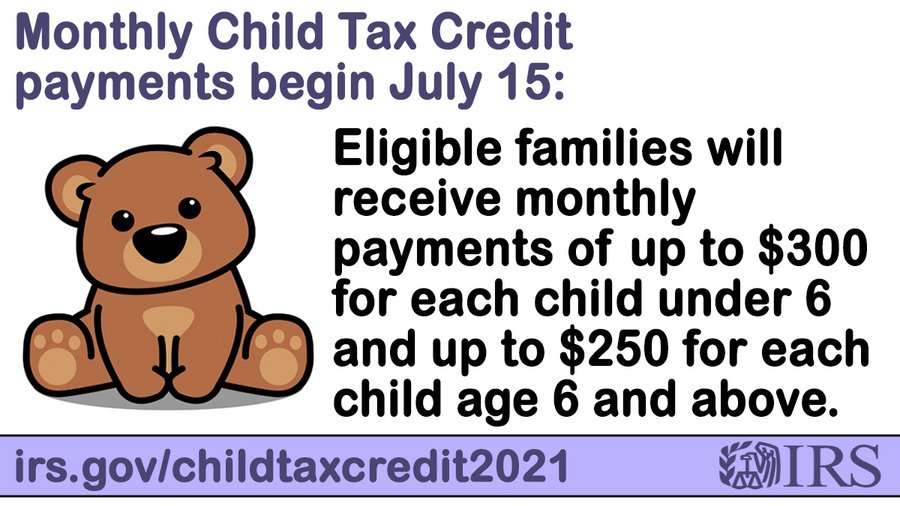

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Get the up-to-date data and facts from USAFacts a nonpartisan source. But others are still pushing for the.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Will payments continue through 2022. Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year.

Payments worth up to 600 and 900 could be sent to parents in February of 2022 if the. I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022. The second half of the child tax credit is set to be disbursed to families when they claim their 2021 taxes next year.

Parents get the remaining child tax credit on their 2021 tax returns. In January 2022 the IRS will send Letter 6419 with the total amount of advance child tax credit payments taxpayers received in 2021. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire.

If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. Without legislative changes the CTC in 2022 will revert to its prior form a 2000 tax credit taken annually versus the expanded CTCs credit of up to 3600 per child with half provided in. Now if the current payment amounts do not pass in Congress.

If nothing is done to extend child tax credits at the current amount CTCs will return to a 2000 lump sum for individuals making up to 200000. As it stands right now child tax credit payments wont be renewed this year. Those checks stopped in January because the.

The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress. 15 but doubts arise around the remaining amount that parents will receive when they file their 2021 income. Therefore child tax credit payments will NOT continue in 2022.

The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec. The Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season. Many people are concerned about how parents.

For families who collected all of the advance child tax credit payments that means the remaining 1800 credit will apply when they file taxes next year. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. Not only that it would have modified it to include the following.

Monday is the next child tax credit payment and then after that there is only one left. However Congress had to vote to extend the payments past 2021. Odds of child tax credit payments starting in 2022.

As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each dependent age 17 or younger.

Child Tax Credit Will Monthly Payments Continue In 2022 King5 Com

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Report Advance Child Tax Credit Payments On Your 2021 Tax Return Cnet

Child Tax Credit Will Monthly Payments Continue In 2022 King5 Com

No More Monthly Child Tax Credits Now What

How Much Money You Ll Get When Child Tax Credit Payments Start This Week Fortune

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Odsp Payment Dates 2022 When Do You Get Your Disability Benefits

36 Million Families Face January Without A Child Tax Credit Check There Will Be Times I Won T Eat Cbs News

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Nearly 4 Million Kids Could Fall Into Poverty This Month Study Says

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor